Mobile Payment Technology: Revolutionizing Commerce and Financial Management in the South African Informal Sector

Transforming the Financial Landscape

The rise of mobile payment technology is significantly altering the financial dynamics in South Africa, especially within the informal sector, where conventional banking services often fall short. In regions where access to banking is limited, mobile payment solutions are not merely an innovation; they are an essential tool for overcoming barriers that have historically hindered economic growth. Individuals and businesses are recognizing that these technological solutions offer unique opportunities to enhance financial engagement and management.

Understanding the Challenges

South Africa’s informal economy encompasses about 25% of the nation’s GDP, a staggering figure that illustrates the dependency on cash transactions. Informal vendors, local markets, and small businesses often operate without the safety net offormal banking services. As a result, traditional methods of payment pose significant challenges, including the risks associated with carrying cash and the inefficiencies involved in cash handling.

Revolutionizing Transactions

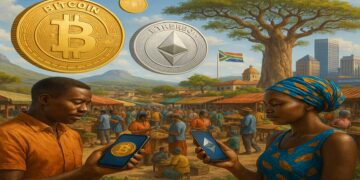

Mobile payment technology addresses these challenges head-on. For instance, applications such as SnapScan and Zapper allow users to make purchases simply by scanning a code with their smartphones. This seamless process not only speeds up transactions but also reduces the clutter and risk of loss associated with cash handling.

Furthermore, the convenience of mobile payments enhances customer satisfaction, as transactions are completed in a matter of seconds rather than minutes. This speed is especially critical during busy market hours, where vendors might serve numerous customers in quick succession.

Enhancing Financial Inclusion

One of the most compelling benefits of mobile payment technology is its ability to promote financial inclusion. Many South Africans lack access to formal banking services, leaving them vulnerable in economic transactions. Mobile platforms allow these users to conduct financial activities—such as saving, sending money, and even applying for microloans—without needing a traditional bank account. This shift is empowering many in the informal sector to take control of their financial futures.

Driving Economic Growth

As more consumers and businesses adopt mobile payment solutions, the potential for economic growth expands. The reduction in transaction fees compared to traditional banking services enables both savings and reinvestment in local businesses. For example, a small vendor can save on banking transaction costs, providing more competitive pricing or increasing stock, further enriching the local economy.

Moreover, with the South African government actively promoting digital financial services as part of its broader economic strategy, the landscape is ripe for continued growth in mobile payments. Initiatives aimed at enhancing digital literacy and access to mobile devices are likely to see this trend escalate rapidly.

In conclusion, the embrace of mobile payment solutions significantly shapes the trajectory of commerce and economic management within South Africa’s informal sector. As technology continues to evolve, its integration into the everyday financial practices of South Africans serves as a promising indicator of broader financial inclusivity and economic empowerment.

CHECK OUT: Click here to explore more

The New Era of Financial Transactions

The introduction of mobile payment technology is not just a shift in how transactions are executed; it’s a complete transformation in the way consumers and businesses in the informal sector of South Africa manage their finances. It offers a suite of services that streamline payment processes and introduce efficiencies that were previously unimaginable for many vendors operating outside the conventional banking system.

In urban areas, bustling with informal traders, the adaptability of mobile payment systems has become integral to their daily operations. Vendors at markets such as Braamfontein and Nelson Mandela Square have started to embrace these digital payment solutions, which are rapidly becoming the norm rather than the exception. Adopting mobile payment applications not only fosters a positive customer experience but also builds trust and reliability in the marketplace.

Consider the advantages of mobile payments for informal vendors:

- Reduced Operational Costs: By implementing mobile payment solutions, small businesses can significantly lower their transaction fees, which traditionally eat into profit margins.

- Enhanced Security: Without needing to carry cash, vendors minimize risks associated with theft and loss. Transactions through mobile wallets are encrypted, showcasing an added layer of security.

- Increased Customer Reach: Customers are more likely to engage with businesses that offer flexible payment options. Mobile payments can attract a broader base of consumers, including tech-savvy youth who prefer not to use cash.

Moreover, as South Africa’s smartphone penetration continues to rise—now at around 90%—it becomes increasingly accessible for many informal entrepreneurs. In a country where over 70% of the population has access to mobile internet, the integration of mobile payments into daily transactions feels not only natural but necessary.

In addition, the growing acceptance of mobile payments among consumers fosters a culture of accountability and transparency. With real-time transaction tracking, vendors can easily manage their revenues and expenses, leading to improved financial literacy. This newfound visibility encourages vendors to practice better budgeting and financial planning, essential skills for long-term sustainability.

The momentum toward adopting mobile payments is further propelled by the partnerships formed between established financial institutions and technology companies. Financial service providers such as Standard Bank and Absa are teaming up with fintech innovators to secure mobile payment solutions tailored for the informal market. Programs that provide training in using these technologies are empowering business owners and catalyzing economic growth within their communities.

Looking ahead, the future of commerce in South Africa’s informal sector appears increasingly intertwined with mobile technology. As mobile payment solutions become more sophisticated and user-friendly, the potential to enhance economic participation and drive sustainable development remains enormous. The informal sector stands on the threshold of a financial renaissance that could reshape its landscape, offering a glimpse into a more inclusive economic future.

CHECK OUT: Click here to explore more

Empowering Small Business Owners

As mobile payment technology permeates the informal sector, it is not only reshaping financial transactions but also empowering small business owners in unprecedented ways. This transformation is vital in a country where small businesses are a cornerstone of economic growth and job creation. By leveraging mobile payment systems, entrepreneurs are able to enhance their business offerings and operational capabilities.

One significant advantage is the ability to offer loyalty programs. Through mobile applications, vendors can track customer purchases, enabling them to reward repeat customers with discounts or special promotions. This personalization not only encourages customer retention but also cultivates a sense of community among vendors and their clientele, establishing long-term relationships that can weather economic shifts.

Furthermore, mobile payments have set the stage for greater financial inclusion. Approximately 28% of South Africans are still unbanked, according to recent estimates. Mobile payment solutions provide a critical bridge for these individuals, allowing them to participate in the economy without the need for traditional banking infrastructure. For instance, platforms such as SnapScan and PAYFast allow users to quickly and easily make transactions, bypassing the need for bank accounts.

Importantly, mobile payment systems facilitate access to microloans. Traditional banks have often viewed informal sector entrepreneurs as high-risk customers, limiting their access to credit. However, with accurate transaction histories provided by mobile payment apps, lenders can evaluate borrowers based on their financial behavior rather than relying on conventional credit scoring models. This potential for credit accessibility encourages entrepreneurs to invest in inventory, expansion, or even formalizing their businesses.

Training initiatives are emerging to help these business owners fully leverage mobile payment technologies. Organizations collaborating with local municipalities are providing workshops that focus on digital literacy. Participants learn how to navigate apps, manage their accounts, and utilize financial tools effectively. This education is key not just for immediate financial success but also for long-term sustainability and growth.

Mobile payment technology also has a profound impact on supply chain management for informal vendors. By utilizing digital transactions, suppliers can better track orders, payments, and inventory levels in real-time, paving the way for a more responsive and efficient supply chain. This interconnectedness enhances vendor reliability, which is much appreciated by customers who increasingly value prompt and reliable service.

Additionally, the role of mobile payment platforms in generating valuable data insights cannot be overlooked. Businesses can analyze customer buying patterns and preferences through transaction data, allowing them to tailor their offerings more effectively. This data-driven approach equips entrepreneurs with vital market intelligence to make informed decisions and innovate their product lines, ultimately contributing to a more competitive landscape in the informal sector.

In summary, mobile payment technology is not merely a tool for transactions but constitutes a multifaceted opportunity for empowerment and growth within the South African informal sector. By embracing these solutions, small business owners are not just keeping pace with technological advancements; they are positioning themselves at the forefront of a financial revolution that is likely to resonate across the entire economy.

SEE ALSO: Click here to read another article

Conclusion

In the dynamic landscape of South Africa’s informal sector, mobile payment technology emerges as a game-changer, redefining how commerce and financial management are perceived and implemented. As small business owners increasingly adopt these digital payment solutions, they not only streamline their operations but also foster deeper connections with their customers through effective engagement strategies, such as loyalty programs.

The potential of mobile payments extends well beyond convenience; it plays a crucial role in promoting financial inclusion for millions of unbanked South Africans. As stated, nearly 28% of the population remains outside traditional banking. Mobile platforms provide these individuals with a cost-effective entry point into the financial ecosystem, enabling access to services they have historically been denied. This widening reach also facilitates access to microloans, empowering entrepreneurs to take significant leaps in their business endeavors.

Moreover, the advent of data analytics within mobile payment systems allows vendors to tailor their offerings, ultimately enhancing customer satisfaction and driving sales. By utilizing transaction insights, business owners gain valuable intelligence that supports innovative strategies and competitive advantage in a challenging market. Training initiatives further ensure that these entrepreneurs are well-equipped to navigate the digital landscape effectively.

Ultimately, by embracing mobile payment technology, the South African informal sector stands on the brink of a financial renaissance. As small businesses leverage these tools, they not only improve their financial management but also contribute to broader economic growth and job creation. This technological revolution encourages us to rethink traditional commerce and imagine a future where every South African can participate fully in the economy. The journey has just begun, and it is one that certainly warrants ongoing exploration and engagement.

James Carter is a financial writer and advisor with expertise in economics, personal finance, and investment strategies. With years of experience helping individuals and businesses make complex financial decisions, James offers practical insight and analysis. His goal is to give readers the knowledge they need to achieve financial success.