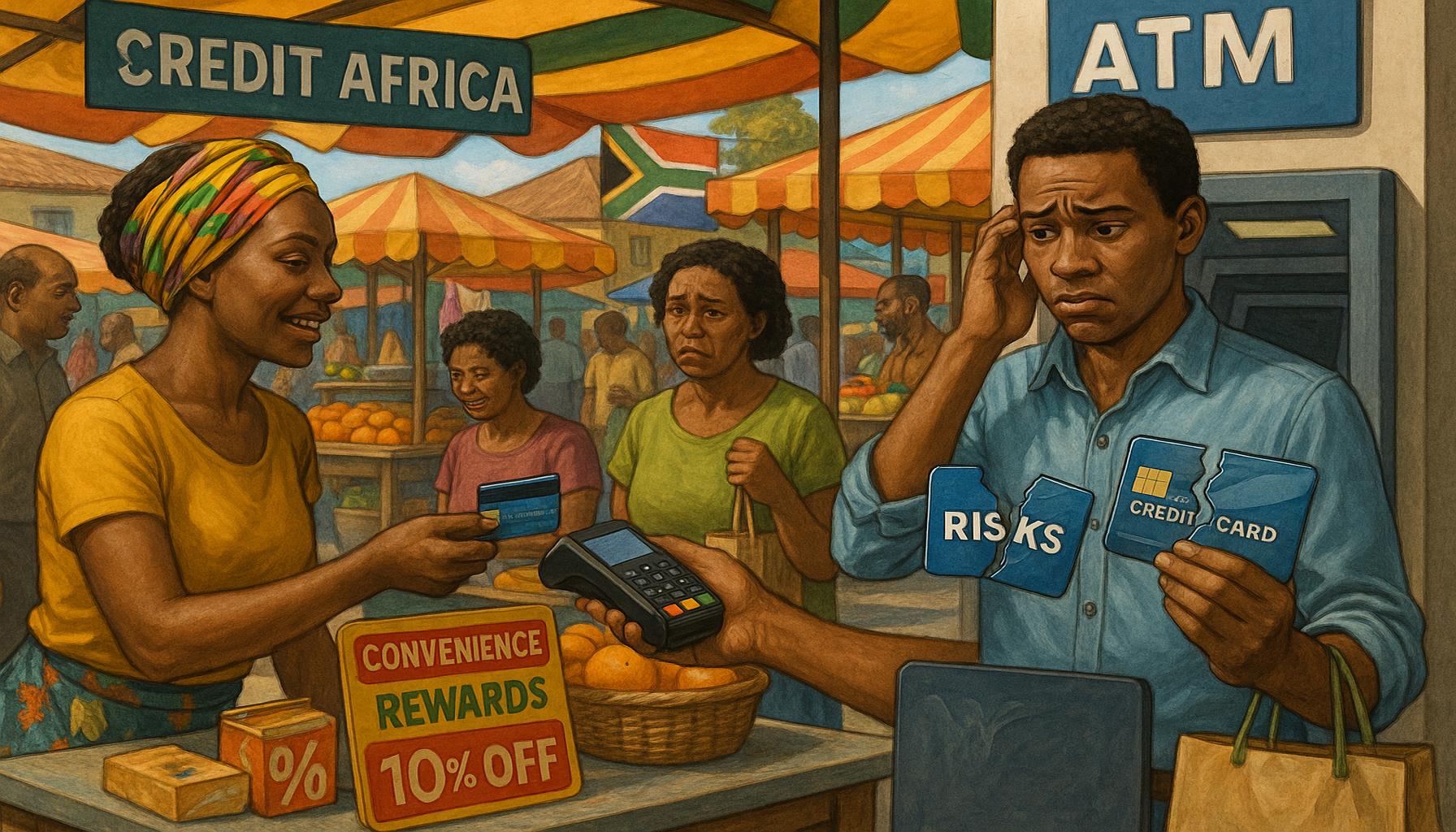

The Pros and Cons of Using Credit Cards in South Africa

The Role of Credit Cards in South Africa’s Financial Landscape

In recent years, credit cards have woven themselves into the financial fabric of South Africa, emerging as a convenient option for transactions both big and small. For many consumers, the allure of cashless transactions is undeniable, offering a quick and efficient method to make purchases without the need to carry physical currency. Beyond mere convenience, credit cards come equipped with a suite of benefits that can enhance financial management, provided they are used judiciously.

Exploring the Benefits

- Convenience of cashless transactions: Credit cards simplify shopping experiences, allowing consumers to pay for goods and services without the hassle of cash handling or searching for change. This is particularly beneficial in urban areas like Johannesburg or Cape Town, where many businesses and services such as taxi rides and restaurants prefer card payments.

- Rewards programs offering cash back and discounts: Many credit card issuers in South Africa have developed enticing rewards programs. For instance, certain cards offer cash back on grocery purchases or travel-related spending, which can effectively reduce overall expenses. Loyalty points can also be accrued for discounts on future purchases, enhancing their value.

- Building credit history: Using a credit card responsibly is a powerful way to build and improve one’s credit score. This is vital in South Africa, where a good credit history can be the key to securing loans, mortgages, or even rental agreements.

- Emergency financial support: Credit cards can provide a safety net during unexpected financial emergencies, such as medical expenses or urgent repairs. This can alleviate the immediate pressure by allowing consumers to manage their cash flow more effectively.

Weighing the Drawbacks

However, the use of credit cards is not without its drawbacks. As appealing as the benefits may be, they can quickly turn into financial pitfalls if not handled carefully.

- High-interest rates can lead to debt: One of the most concerning issues with credit cards in South Africa is the high-interest rates that can accrue on outstanding balances. If consumers do not pay off their debt in full each month, they may find themselves trapped in a cycle of ever-increasing debt.

- Overspending due to available credit: The easy access to credit can lead to impulsive spending, causing users to exceed their budget. This behavior is particularly prevalent among younger consumers, who may not fully grasp the implications of their spending habits until it is too late.

- Fees for late payments or annual maintenance: Many credit cards come with annual fees, and failure to make timely payments can incur additional costs in the form of late fees. These costs can quickly add up, potentially negating the benefits of rewards or cash back.

Understanding both the advantages and challenges of credit cards is critical for consumers navigating South Africa’s complex financial landscape. By being mindful of spending habits, individuals can harness the benefits of credit while avoiding common pitfalls. In a country where financial literacy is essential, gaining insight into credit usage can help empower consumers to make informed financial decisions that positively impact their overall financial health.

SEE ALSO: Click here to read another article

The Power of Credit Cards in Modern Financial Management

In today’s fast-paced economic environment, credit cards have evolved into indispensable financial instruments, particularly for South Africans navigating complex purchasing landscapes. Beyond being a mere substitute for cash, credit cards can empower consumers, offering advantages that enhance both shopping convenience and financial stability. Understanding these benefits is crucial for any consumer aiming to leverage their credit card usage effectively.

Key Benefits of Credit Card Usage

- Convenience of transactions: The convenience offered by credit cards is one of the main reasons for their popularity. Consumers can make quick payments without the need to carry physical cash, whether purchasing at local markets in Durban or dining out in Pretoria. Merchants increasingly prefer card payments, and many places have adopted contactless technology, making transactions faster than ever. For instance, South African consumers can simply tap their cards or smartphones at many retailers, enhancing both speed and simplicity during the checkout process.

- Rewards and loyalty benefits: Many credit cards in South Africa come with specialized rewards programs designed to incentivize regular spending. For example, specific cards provide cash back on essential purchases like fuel or groceries, translating everyday expenses into tangible benefits. Additionally, points accrued through these purchases can often be redeemed for enticing rewards, including travel discounts or retail shopping coupons, essentially allowing consumers to save money while enjoying their purchases. Promotions and partnerships with local businesses also add value, providing cardholders with exclusive deals not available to cash-paying customers.

- Strengthening credit profiles: Consistent and responsible credit card usage is instrumental in building a robust credit history. In South Africa, a good credit score is pivotal as it influences future borrowing opportunities, such as securing favorable interest rates on personal loans or mortgages. Responsible management includes promptly paying off balances and keeping utilization rates low. By maintaining good credit habits, consumers not only improve their individual credit profiles but also gain access to better financial products and services down the line.

- Emergency financial flexibility: Credit cards can serve as a crucial financial safety net during unexpected situations. Whether confronted with unforeseen medical expenses or urgent home repairs, possessing a credit card provides immediate access to funds without the need to liquidate investments or disturb savings. This flexibility allows individuals to address emergencies swiftly while managing repayments over time, reducing the stress that often accompanies financial crises.

- International acceptance: For South Africans traveling abroad, credit cards offer an efficient and secure payment option. They are widely accepted globally, alleviating the need to exchange large sums of cash that might be subject to varying exchange rates. Additionally, credit cards often come with built-in fraud protection features that minimize the risks associated with carrying cash or using ATMs overseas, providing travelers peace of mind as they explore new destinations.

While these benefits present a compelling case for credit card usage, consumers must approach this financial tool with prudence. It is vital to maintain a clear understanding of potential pitfalls, such as accruing debt due to high-interest rates or unintended overspending. Just as leveraging the advantages of credit cards can enhance financial well-being, misuse can lead to significant challenges. Therefore, consumers are encouraged to educate themselves further on responsible credit management techniques and the broader implications of credit usage.

SEE ALSO: Click here to read another article

Balancing Act: The Drawbacks of Credit Card Usage

Despite the myriad benefits of credit cards, South African consumers must be cognizant of the challenges that can arise from their use. A comprehensive understanding of the drawbacks is essential to ensure that individuals make informed financial decisions. The allure of convenient shopping and exciting rewards can often overshadow the responsibilities that come with credit card ownership, leading to serious pitfalls if not managed properly.

Potential Drawbacks of Credit Card Usage

- High-Interest Rates: One of the most significant concerns associated with credit card usage is the potential for high-interest rates. Many credit cards in South Africa impose annual percentage rates (APRs) that can range from 15% to upwards of 30%, depending on the issuer and the consumer’s creditworthiness. If cardholders fail to pay off their balance in full every month, they can quickly find themselves burdened by escalating debt that compounds interest. It is crucial for consumers to be aware of these rates and to track their expenditures diligently to avoid falling into a debt spiral.

- Overspending Temptation: The ease of using credit cards can lead to a phenomenon known as “spending regret.” With the ability to make purchases without immediate financial consequences, consumers may unintentionally overspend. This is particularly problematic in a society where peer influence and lifestyle aspirations can fuel extravagant buying behaviors. Research has shown that credit card users often spend more than cash users, which may result in a compromised budget and stunted financial growth.

- Risk of Identity Theft and Fraud: While credit cards come with fraud protection, they are not immune to threats. The prevalence of cybercrime in South Africa has raised alarms about the safety of personal financial data. Identity theft can have devastating effects, leading to unauthorized charges and a long process to rectify financial records. South African consumers should frequently monitor their accounts, utilize secure online shopping practices, and consider regular credit report checks to mitigate these risks.

- Fees and Charges: Credit cards often carry a host of fees that can accumulate quickly and unexpectedly. From annual fees for maintaining the card to charges for late payments, foreign transaction fees, and cash advance fees, these costs can erode the benefits of using the card. For example, South Africans traveling abroad should be wary of foreign transaction fees that could add up during their trips. Consumers must read the terms and conditions thoroughly and factor in these fees when weighing the advantages of different credit cards.

- Long-Term Debt Cycles: Regularly relying on credit cards for daily expenses can lead to long-term debt cycles that are challenging to escape. Many South Africans find themselves in a trap where they are continually paying off old debt while accruing new debt, creating a revolving door that can compromise financial health. It is advisable for consumers to use credit cards judiciously and aim for a balanced approach to their finances, making sure they maintain a healthy debt-to-income ratio.

Recognizing the associated risks and weighing them against the benefits will empower consumers to make strategic choices about their credit card use. By establishing a disciplined financial routine that includes budgeting, paying off balances in full, and understanding the terms of their credit arrangements, South Africans can successfully navigate the challenges while still enjoying the perks that credit cards can offer.

SEE ALSO: Click here to read another article

Conclusion: Navigating the Credit Card Landscape

In summary, credit cards present both significant advantages and inherent risks for South African consumers. The ability to earn rewards, build credit histories, and access flexible payment options makes them a powerful financial tool when used wisely. However, the potential for high-interest debt, overspending, fees, and the risk of fraud cannot be overlooked. Understanding both sides of this financial instrument is crucial for making informed decisions.

As South Africans increasingly embrace a cashless society, responsible credit card management becomes paramount. Establishing a budget, paying off balances promptly, and selecting credit cards with favorable terms can significantly mitigate risks. Additionally, staying vigilant against fraud by monitoring transactions and utilizing secure online practices is essential in today’s digital landscape.

For those contemplating credit card use, it’s essential to remain aware of personal financial habits and the long-term implications of credit dependency. With approximately 40% of South African households reportedly relying on credit to manage expenses, consumers must tread carefully to avoid the pitfalls of debt cycles. Ultimately, informed consumers who approach credit cards with caution can harness their benefits while minimizing risks. As the financial landscape continues to evolve, equipping oneself with knowledge will pave the way for greater financial literacy and success. Understanding the fundamental principles of credit card usage not only enhances individual financial well-being but also contributes to the broader stability of South Africa’s economy.

James Carter is a financial writer and advisor with expertise in economics, personal finance, and investment strategies. With years of experience helping individuals and businesses make complex financial decisions, James offers practical insight and analysis. His goal is to give readers the knowledge they need to achieve financial success.